AMIRIS

AMIRIS is the open Agent-based Market model for the Investigation of Renewable and Integrated energy Systems. It aims at enabling scientists to dissect the complex questions arising with respect to future energy markets, their market design, and energy-related policy instruments. AMIRIS computes electricity prices endogenously based on the simulation of strategic bidding behaviour of prototyped market actors. This bidding behaviour does not only reflect marginal prices, but can also consider effects of support instruments like market premia, uncertainties and limited information, or market power.

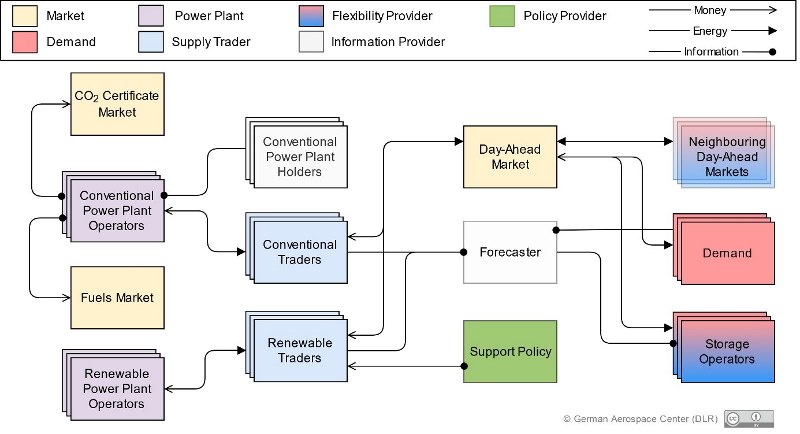

In AMIRIS, actors are represented as agents that can be roughly divided into six classes: Power plant operators, traders, marketplaces, policy providers, demand, and storage facilities. Power plant operators provide generation capacities to traders, but do not trade on the markets themselves in the model. Instead, supply traders conduct the marketing and employ bidding strategies. Marketplaces serve as trading platforms and organize market clearing. Policy providers define a regulatory framework which impacts the decisions of other agents. Demand agents request energy directly at the electricity market. Finally, flexibility providers, e.g., storage operators, use forecasts to determine bidding patterns matching their objective.

AMIRIS enables investigating the influence of political framework conditions on the behaviour and profitability of energy market actors, considering their uncertainties, incomplete information, effects of support instruments as well as their competition across different markets.